Title insurance costs have garnered a lot of attention recently. The president mentioned them in the State of the Union address. Multiple executive agencies have announced initiatives that affect closing costs generally and title insurance specifically. And amidst this unusual attention, prominent voices in the title insurance industry have made claims about the value of title insurance, whether it is expensive for the risk covered, and how and who should pay for it.

This post does not purport to end any of those debates. But because Doma has been operating in the market for several years with a different method of underwriting for lender’s title insurance for refinances, we wanted to make some of our data available. Overall, that data suggests that lender’s title insurance for refinances has historically been inefficiently priced, and that these inefficiencies get passed on to the consumers who pay higher fees as a result. And it also suggests that technology can be used to reduce these prices safely and securely.

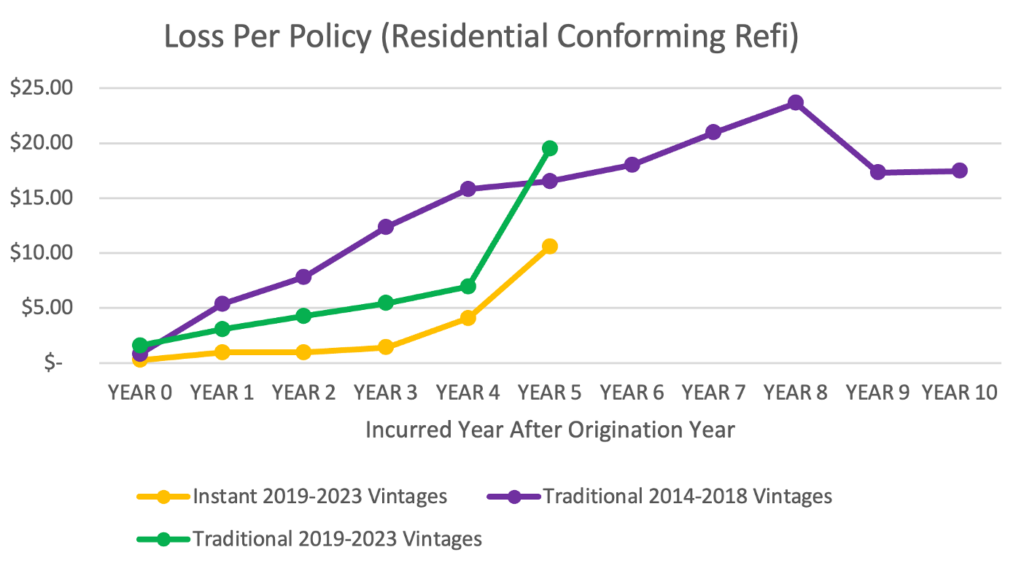

First, we’ve compared average cumulative claims loss for conforming refinance loan policies, underwritten either via traditional methods or through our patented instant underwriting model, which conducts more efficient title search and examination processes that generate an insurance policy at lower cost than traditional underwriting. “Loss” here means not only the amount of any title claim itself but also the third-party legal and investigation expenses that we’ve incurred when processing a claim. To get to an “average cumulative claims loss,” we measure cumulative loss curves for policies written in each year (a “vintage”) separately, then average all cumulative curves for all vintages.

The results:

As you can see, losses on conforming refinance loan policies instantly underwritten using our patented model compare favorably through year five both to traditionally underwritten vintages from the years 2014-2018 and to those from the years 2019-2023. In short, this data suggests that Doma’s instant underwriting does not produce more losses per policy than traditional underwriting.

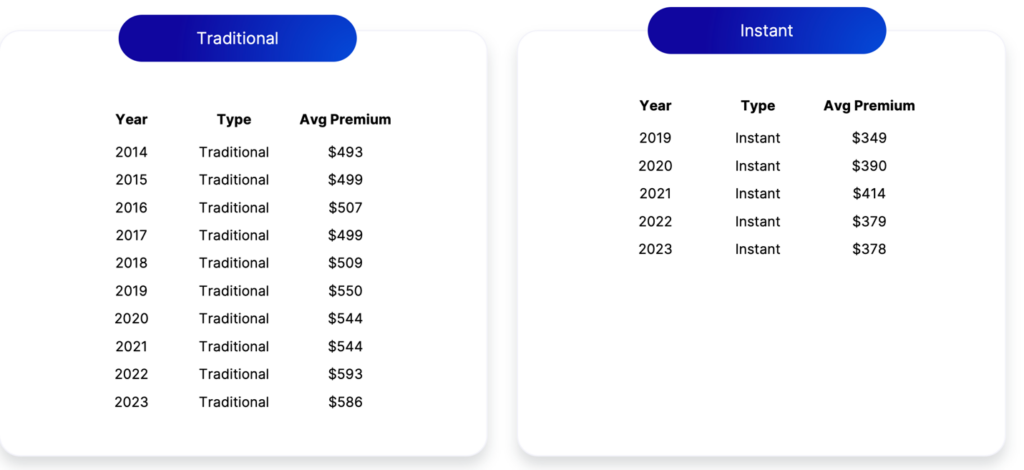

Second, all of this is true despite the fact that the average gross written premium on instantly underwritten loans is substantially lower than that on traditionally underwritten loans. The table below compares these prices for different vintages. The average premium on an instantly underwritten file by vintage ranges from 63% (for 2019) to 76% (for 2021) of the average premium on a traditionally underwritten policy.

So on lender’s title insurance for refinances, our instantly underwritten policies cost consumers less and result in no more (and perhaps fewer) claims for lenders. That suggests that the traditional pricing model is inefficient and costs consumers more than necessary, even setting aside the fact that lender’s title insurance does not cover the consumer at all. More widespread deployment of modern technology, like Doma’s instant underwriting model, would reduce costs for consumers without incurring additional risk.

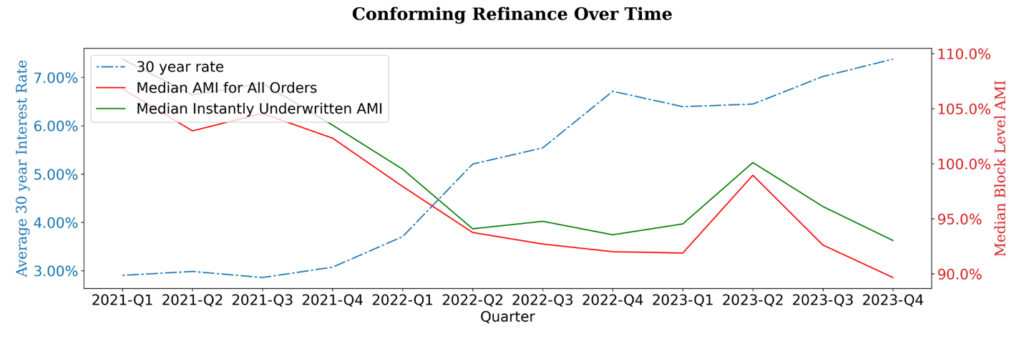

One last point: some might reasonably ask which consumers are refinancing with interest rates as high as they are and given the speed with which they increased from their pandemic nadir. The answer, at least as suggested by our data, is sobering.

When we looked at the conforming refinances that we’d underwritten over the period when interest rates rose from 3% to 7%, we saw a clear trend, shown below: most people who are taking out conforming refinances now are low- and moderate-income borrowers (typically defined as those with an income level below 120% of the median income level for their census area). We suspect that only those who urgently need money or who have suffered some life event that necessitates a change in title, such as a divorce or the death of a partner, would need to complete a refinance at such high interest rates. And this makes deploying technology to reduce lender’s title insurance prices even more important, because lender’s title insurance is often the single largest closing cost on a refinance and is disproportionately expensive for small-balance loans.

Overall, then, our data supports the notion that:

- Lender’s title insurance for refinances is inefficiently priced.

- Modern technology can reduce prices without creating additional risk for lenders or borrowers.

- The typical refinance borrower today has a lower income than the typical refinance borrower three years ago and therefore would benefit even more from reduced lender’s title insurance fees—which our instant underwriting product, which provides safe outcomes and more affordable policies, provides.

A full deck, with the above graphics and slides about methodology, is available here.

We at Doma have spent more than seven years developing innovative solutions to reduce closing costs for consumers. We plan to continue innovating to do just that, and we hope that other companies in our industry invest in similar technology to do the same.