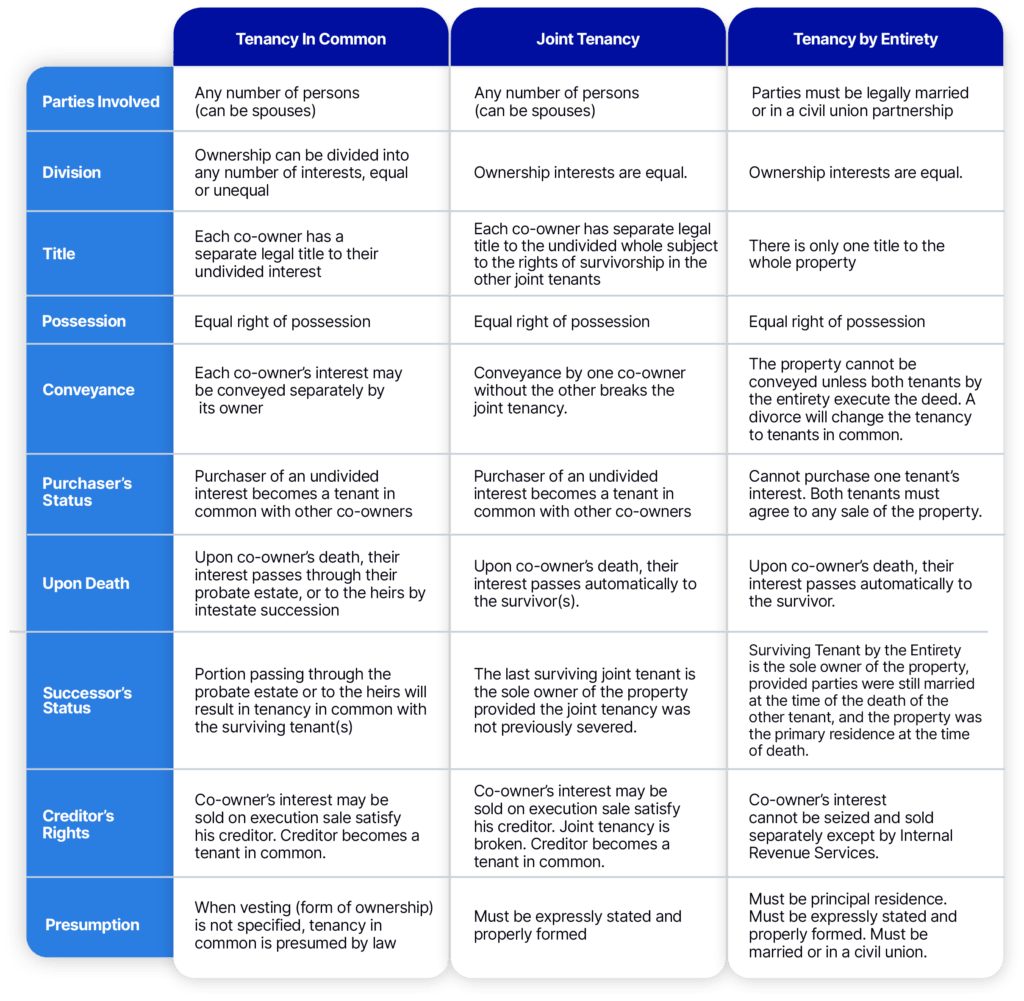

Because real property is among the most valuable of assets, the question of how you take ownership of your property is of great importance. The form of ownership taken – the vesting of title – provides guidelines for how a property should be passed, should one or all of the property owners become deceased.

Tenancy In Common

A tenancy in common is created whenever an instrument conveys an interest in real property to two or more persons and specifies tenancy in common. If a recorded conveyance document does not expressly specify the tenancy (joint tenancy, community property, etc.), the legal presumption is that the vesting is tenancy in common. The interest in the property owned may be any fraction of the whole; thus one party may own one-tenth, another three-tenths, and a third party may own the remaining three- fifths. There is no right of survivorship; each tenant owns an interest that vests in his or her heirs or devisees upon death.

Joint Tenancy

When a joint tenant dies, his or her interest in the property is terminated, and the surviving joint tenant(s) automatically inherit the interest in the property. The main characteristic of joint tenancy is the right of survivorship. When a joint tenant dies, his or her interest in the property is terminated, and the estate continues in the survivor or survivors.

Upon the death of one joint tenant, the title automatically passes to the survivor. Title insurance companies will require some formal procedure before recognizing the new owner. Two methods are followed: Filing an Affidavit of Death of Joint Tenant or obtaining a court decree of death of joint tenant.

Tenancy by Entirety

A married couple retains the same interests in a property title under a tenancy by the entirety. Neither owns more nor less than the other. Neither can sell, gift, or transfer any stake in the property on her own. Everything pertaining to title must be completed by both couples together, otherwise nothing will be done.

This article is part of the Home Buyer Guide.